Department Budgeting Solved – Or at Least Helpful Hints

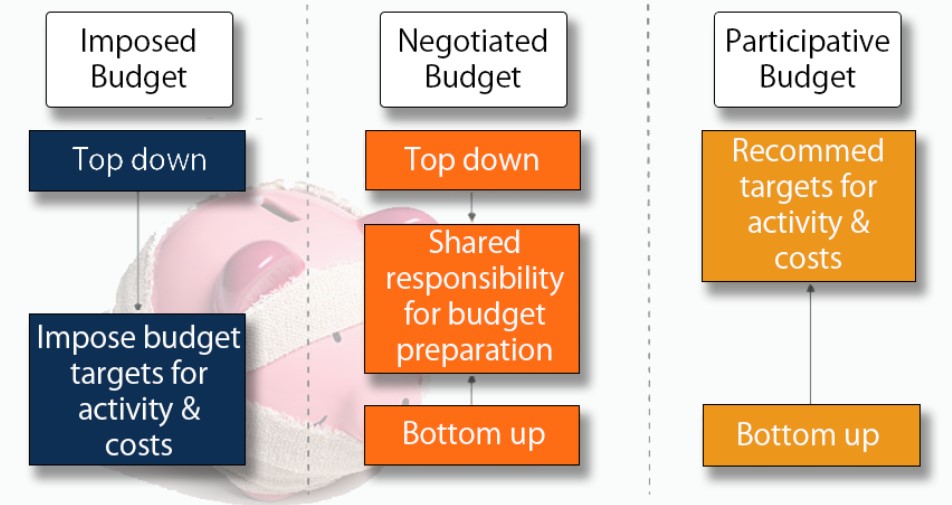

This article focuses on the different ways to approach budgeting as they apply to lab managers, manufacturing managers and department heads. For these positions there are different types of budgeting that are seen. They can be summarized below and are an essential planning mechanism to a smooth-running department.

Budgeting is how the manager provides what personnel need to achieve not just the organization’s short-term goals, but to start the journey to the long-term strategic goals. Budgeting is often overlooked when the day-to-day business and operations are all consuming. Without a plan there are pitfalls that create long term problems.

Common budgeting difficulties include:

- Loss of financial control, leading to debt and inability to deal with unexpected expenses

- Overspend or underspend which greatly influences future budget approvals.

- Less confidence in resources being used in the most efficient manner possible and general stress.

Any of these issues will lead to the team being unable to achieve the goals that have been set out for the department and cause deviation from the path for the long-term vision of the future. We have put together an overview of budgeting best practices which will help identify any looming icebergs or, at least put your mind at ease that there is clear sailing ahead.

Budgeting involves mathematical acumen, attention to detail, and making informed decisions about fund allocation. However, anyone involved in scientific fields has these skills and the opportunity to fully leverage this task that is often overlooked by other corporate departments.

Some of the main benefits of an all-encompassing budget are prioritizing key projects, ensuring resource availability, setting internal goals, and tracking progress. A good budget will also act as the foundation of a contingency plan in the event of the unexpected.

Identifying the Budget Need

When identifying needs, it is more constructive to be transparent about the needs of all and bring in all the operational personnel for a review, after all they will be the most affected by the fund allocation. There is certainly a need to have a formal report which outlines needs and current resources, but there is also the informal aspect to this review where opinions and ideas generate the creative and dynamic environment within an organization.

One top method is to have a brainstorming session where a wish list is created and prioritized as a group exercise. Then a budget request list is allocated a weighting based on ‘this would be nice’ – to – ‘we cannot function without this’. This can be a fun team exercise that is followed up with further drilling down into cost benefits of each request.

Important questions to ask here would be:

- How much are we willing to pay for this?

- When will it be needed? How long will it last?

- Can we use this resource for another purpose?

- Are there ancillary costs around this resource? (training, upskilling, maintenance, depreciation, etc.)

- Is there something special about this resource that will make us more productive, competitive, unique?

- Does this fit into the current vision for the department, and if not, could it be worth exploring new opportunities?

- Does this fit with where we want to be in five years? If there is not an immediate need, will we be playing catch-up then?

Budgets can fall off a cliff if they are not monitored. It is important to recognize that there will always be a capital spending ceiling. This does not prevent spending on new avenues but will require compromises in other activities. Another tip here is to work closely with the financial department as there are different tax systems or ongoing expenditure, they can advise on.

Getting a Budget Approved

The most common way to get a budget approved is to supply the numbers. You would think that return on investment (ROI), backed by statistical evidence, is unassailable but this is not necessarily the case. When requests are also framed in a manner that aligns with the organization’s long-term strategy backed by examples of orthogonal methods used by other departments or organizations there is a complete case as to why the budget should be approved.

- Be prepared and have an outlined plan: It is a common bias to think that everyone in the company understands the processes and technologies a department is developing to achieve the organization’s goals. Presenting a breakdown of each itemized cost is a better way of engaging with budget holders and will give everyone an aligned picture of how the overall corporate strategy will be achieved with this budget allocation. A transparent discussion will benefit all departments.

- Know the marketplace: Strategic foresight and market opportunities are a poignant topic to bring up in any budgeting request. Having comparisons of the organization vs competitor companies and forecast market movements will aid in getting key stakeholder support for new initiatives.

- While there may not be a clear and immediate return on investment on requested expenditure there may also be a case that, to not do so, would lead to a loss of market leadership. A budget that is too rigid can lead to loss of innovation. This stagnation also has a considerable effect on staff retention leading to knowledge loss.

- Arguably the proposed budget negotiation step is the hardest one. The most important part of negotiation is to emphasize the outcomes and balance the compromises.

There are a few tips for this:

- Make known your intention for the budget early on. By engaging with other stakeholders, you are building support for your plan and preparing them for the formal request.

- Personalities do not factor into a balance sheet, so remember that the overall health of the business is paramount.

- Overestimate. This is not ‘padding’, many budgets run over or hit unforeseen costs. A budget with contingency is prudent planning. Even with a perfectly executed budget, this contingency affords the budget proposal flexibility.

The Procurement Process / Tender Negotiation

The procurement process can be a minefield for the unprepared. The complexity of the new equipment or service can compound the difficulties. Somethings to consider here are:

- Shop around. While this sounds obvious it is important to gain knowledge of the industry standard and what is on the market. Gathering incoming bids gives a good idea of not only the equipment/service that is on offer but also the professionalism of the vendors.

- Define the return and replacement policy of each vendor. This should be followed up by clear and completely unambiguous purchasing agreement. Procurement should have set specifications on the equipment/service, delivery times, after sale service, training schedules, guarantees and warranties etc.

- Beware of hidden costs. The best option is to pick vendors that will continually work with you, regarding your business as a distinct opportunity to grow their business themselves. These suppliers are rare but when seen as a partner in your process their value is not to be underestimated.

Build relationships with the vendors. The easy way to do this is to have a team call with everyone. It is easy to recognize the viability of a vendor fit for your company by a quick conversation.

Getting a New, Bigger Budget

To get a bigger budget in the future, a manager will have to successfully answer two questions:

‘What have you done with the last budget?’

&

‘What are you going to do with the larger one?’

If the last budget is not spent, then why is a bigger one needed? The briefest answer to this is that the department is fiscally responsible. This proves the grounds for a larger budget request that the department will be also accountable for. To achieve progress, investment is needed. The opposite of growth is decay.

Ultimately the success of securing a bigger future budget depends on the use of past budgets. How they are managed, used and the tangible benefits that can be shown are all indicators that an investment in a higher budget will pay off.

Hopefully this article has sparked some ideas of how to use your current budget and how to approach the next one. At InnoGlobal Technology (formerly Innopharma Technology) we collaborate closely with companies to tailor solutions based on their process needs. This consultative experience means we have become experts in navigating budgetary requirements.

We would be happy to take a call with anyone who is currently reviewing their department budget to offer any advice we can provide.